Like many people, you may never have been an agent under a power of attorney before. That's why we created Managing Someone Else's Money: Help for Agents Under a Power of Attorney. This Guide will help you understand what you can and cannot do in your role as an agent or an attorney-in-fact. In that role, you are a fiduciary. In this Guide, you'll find brief tips to help you avoid problems and resources for finding more information.

This Guide is for family and friends already serving as an agent under a power of attorney, not for professionals or organizations. If you want to learn about how to become an agent under a power of attorney or other alternatives, this Guide is not designed for you. If you want to learn more about how to make a power of attorney, read Chapters 751 and 752 of the Texas Estates Code`or contact an attorney.

This guide does not give you legal advice and is not intended to take the place of any training required by law or instruction provided by the court. If you have questions about your duties, talk to a lawyer, read our other guides, and visit the "Seniors and the Law" at the texaslawhelp.org webpage.

How you might have become an agent under a power of attorney

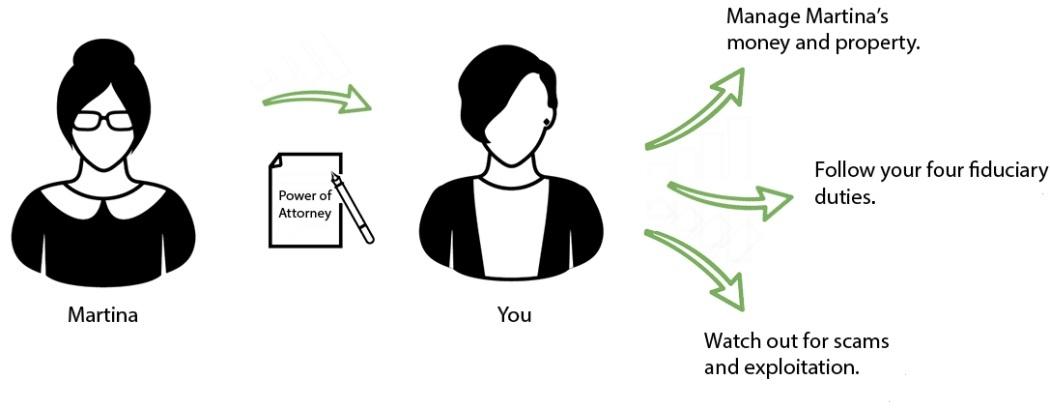

Your family member or friend is worried that she will not be able to pay her bills or make other decisions about her savings and her house. For this Guide, let’s call her Martina. Martina has signed a legal document called a statutory durable power of attorney.

For simplicity’s sake, this legal document is referred to as her power of attorney. In this document, she named you as her agent and gave you broad power to make decisions about managing her money and property. Martina also made her power of attorney effective immediately, instead of after she gets too sick to pay her bills or make other decisions about her savings and her house.

The law gives you a lot of responsibility as Martina’s agent under her power of attorney. You may want to consider having an attorney help you manage this responsibility. You are now a fiduciary with fiduciary duties.