Like many people, you may never have been a representative payee or U.S. Department of Veterans Affairs (“VA”) fiduciary before. That’s why we created Managing Someone Else’s Money in Texas: Help for Representative Payees and VA Fiduciaries. This Guide will help you understand what you can and cannot do in your role as a representative payee or VA fiduciary. In both of these roles, you are a fiduciary. For this Guide, a fiduciary is anyone named to manage money or property for someone else. You’ll find brief tips to help you avoid problems and resources for finding more information.

This Guide is for family and friends already serving as representative payees or VA fiduciaries, not for professionals or organizations. If you want to learn about how to become a representative payee or VA fiduciary, this Guide is not designed for you. You should contact the federal agency that pays the benefits.

Importantly, this Guide does not provide legal advice to you and is not intended to take the place of any training required by law or instruction provided by the court. If you have questions about your responsibilities, talk to a lawyer, read our other guides, or visit the “Seniors and the Law” webpage at TexasLawHelp.org.

How you you might have become a representative payee or VA fiduciary

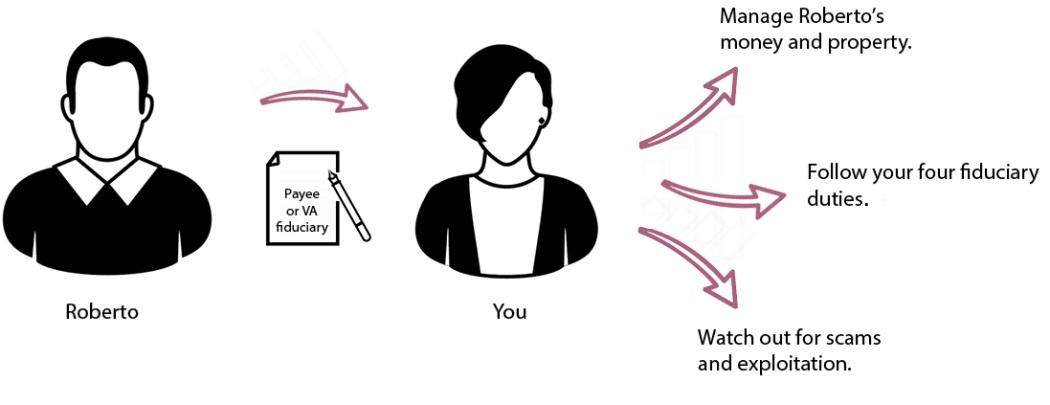

Your family member or friend receives Social Security or VA benefits. For this Guide, let’s call him Roberto. The Social Security Administration has named you as representative payee for Roberto, or the Department of Veterans Affairs has named you as Roberto’s VA fiduciary.

You now have the duty and power to manage his Social Security and/or Veterans Affairs benefit checks.

In these roles, the federal government assigns a lot of responsibility to you on Roberto's behalf.

Under the law, you are now a fiduciary with fiduciary duties.